Al Khafji: A Rising Cross-Border Investment Hub for Saudi Arabia & Kuwait

Over the past decade, Saudi Arabia and Kuwait have rapidly transformed their urban landscapes, turning remote regions into globally recognized hubs of innovation and investment. For instance, AlUla – once a historical site - has become a premier tourism and cultural destination through multi-billion-dollar investments. NEOM - a futuristic megacity emerging from the desert - promises to redefine urban living with innovation and sustainability at its core. Similarly, Kuwait’s Silk City project is set to position the country as a key player in global commerce. These developments emphasize a broader regional shift—strategic investments are reshaping the economic map, creating new opportunities in real estate, infrastructure, and business.

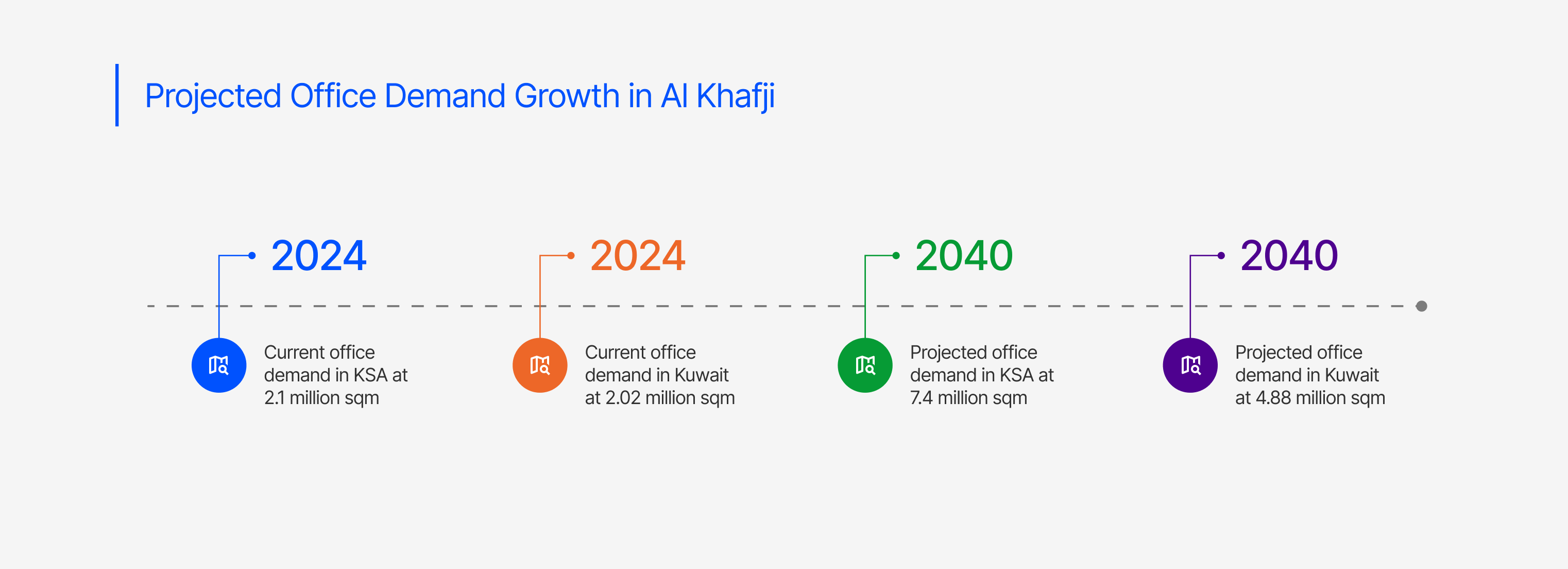

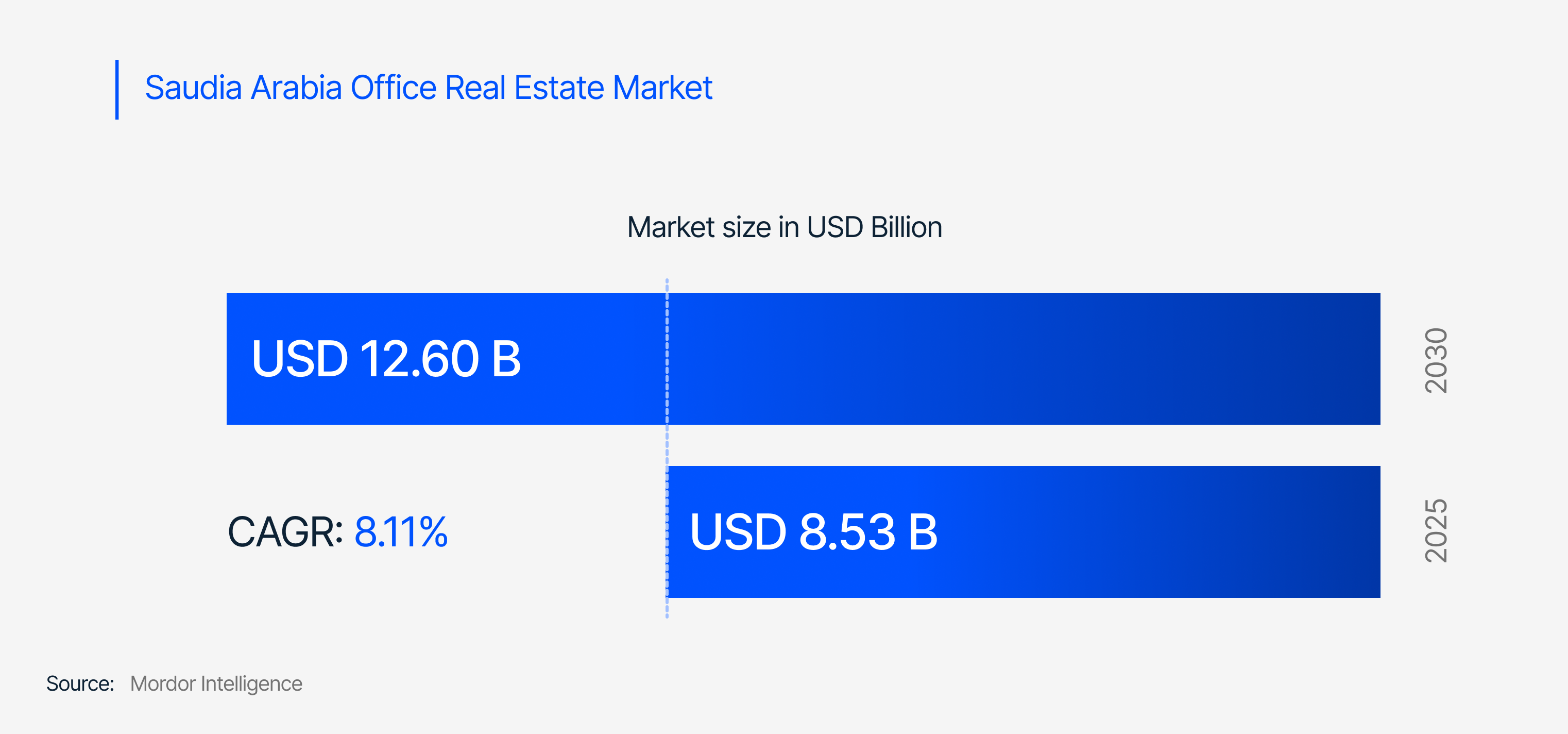

Amidst such robust transformation, Al Khafji - strategically positioned on the Kuwait-Saudi border - presents a unique investment opportunity in real estate, driven by economic diversification plans and demographics. Office spaces in Saudi Arabia and Kuwait offer high yields, stable demand, and strong government support, driven by economic diversification and rising white-collar employment. Office demand in the KSA’s Eastern Province is projected to surge from 2.1 million sqm to 7.4 million sqm by 2040, while Kuwait anticipates an increase from 2.02 million sqm to 4.88 million sqm. Al Khafji’s strategic location, growing office demand, and government-backed infrastructure projects make it a prime real estate investment destination.

Historical Trends & Market Development

Both Kuwait and the KSA have seen significant shifts in their economic landscapes. Kuwait, historically reliant on oil revenues, is actively pursuing diversification under its Vision 2035, aiming to reduce dependence on hydrocarbons by investing in technology, finance, and renewable energy. Similarly, Saudi Arabia's Vision 2030 is driving the Eastern Province towards manufacturing, trade, and professional services.

These regulatory and economic shifts are fostering a more dynamic and resilient real estate market. COVID-19 initially hit office demands due to work-from-home policies. However, the post-COVID world has seen a rise in demand for quality workspaces, especially Grade-A offices. These fluctuations have led to regulatory adjustments and have place greater stress on economic diversification, significantly influencing real estate development strategies. Technological advancements, such as Building Information Modeling (BIM) and sustainable construction practices, are also becoming a trend in the real estate sector.

Economy & Market Dynamics

Investment flows into both regions are increasingly driven by non-oil sectors. In Kuwait, while the nominal GDP saw a massive increase by 2022, it declined in 2023 as the IMF predicted a decline in oil GDP growth due to high oil prices and a contraction in demand. Foreign investment licenses in Saudi Arabia have surged, particularly in retail, construction, manufacturing, and business services. This diversification is creating a fertile ground for real estate investments, especially in office spaces that cater to these emerging industries.

Government Support & Investment Incentives

The real estate investment landscape in both Saudi Arabia and Kuwait is being driven by strong government support, making it more attractive for foreign and local investors. Key government initiatives include:

Economic Diversification Plans (Vision 2030 & Vision 2035)

- Saudi Vision 2030 and Kuwait Vision 2035 focus on shifting from oil dependency to finance, technology, and business services, increasing demand for high-quality office spaces.

- The government actively promotes foreign direct investment (FDI) to encourage private sector participation.

Foreign Investment Reforms

- Saudi Arabia: Offers 100% foreign ownership in select industries.

- Kuwait: Provides tax exemptions and legal protections for foreign investors.

Local Infrastructure & Land Development

- AlSalam Land Project: A 2.6 million sqm development near the Saudi-Kuwait border, offering residential and commercial plots to attract investors and businesses.

- Al Khaleejia Residential Complex: A modern housing project with apartments and villas designed to accommodate Al Khafji’s growing population.

- Municipal Infrastructure Enhancements: Urban development projects improving neighborhoods, municipal squares, and city entrances to enhance Al Khafji’s real estate appeal.

Current Market Scenario

The Eastern Province's office sector is experiencing exponential growth, with Grade A office lease rates escalating by 8% over the past year, reaching SAR 1,000 per sqm, with occupancy levels have rising to 81%. Kuwait's office market is witnessing similar positive trends, driven by an increasing white-collar workforce and a shift towards smart workspaces. Office demand in Kuwait is expected to increase to 3.1 million sqm by 2030 and 4.9 million sqm by 2040. These figures underscore the strong positioning of the real estate sector within the broader economies of both regions.

The real estate market in the Eastern Province is dominated by the Dammam Metropolitan Area (DMA), which accounts for nearly 48% of total office space. In Kuwait, the Capital Governorate (Kuwait City) holds approximately 72% share of office spaces. Both regions are seeing the construction of high-quality international and Grade-A office spaces, catering to multinational corporations, financial institutions, and high-end local businesses.

Market Gaps & Growth Drivers

An undersupply of office spaces in both the Eastern Province and Kuwait presents significant expansion opportunities. By 2040, the Eastern Province is projected to face a market gap of approximately 415,000 sqm, and Kuwait is expected to be undersupplied by 9.3%. This deficit, particularly in Grade-A offices, creates a compelling incentive for investors to develop high-quality office spaces.

Why Al-Khafji?

Al Khafji’s strategic location on the Saudi-Kuwait border makes it a high-potential commercial and real estate investment hub. Unlike other Saudi cities, it serves as a cross-border business gateway, benefiting from trade, logistics, and energy-sector investments. The city plays a crucial role in regional commerce, attracting businesses that seek proximity to Kuwait’s financial sector and Saudi Arabia’s industrial zones. The presence of Al Khafji Joint Operations (KJO), managed by Saudi Aramco and Kuwait Gulf Oil Company, ensures active corporate demand for office spaces. Unlike Dammam or Riyadh, Al Khafji faces an undersupply of Grade-A offices, creating an opportunity for investors to secure high rental yields and long-term corporate contracts.

Investing in Al Khafji means entering a rising market with less competition compared to major Saudi & Kuwait cities, where office space is becoming increasingly hard to find. Its unique position as a border economic hub, combined with corporate stability, makes it a prime real estate investment destination over other regions.

For further information, please visit our Growth & Advisory page to explore how Akseer can assist in achieving your strategic objectives.

Contributors

Adeel Ahmed

Research Editor

Share With